accumulated earnings tax form

The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. The Tax Court held for the IRS on both the compensation and accumulated earnings tax issues.

Income Tax return must be taken into account to determine eligibility for the Senior Freeze.

. However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to. Multiply each 4000 distribution by the 0625 figured in 1 to get the amount 2500 of each distribution treated as a distribution of current year earnings and profits. The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit.

This BIR form is to be filed by every domestic corporation classified as closely-held corporation except banks and other non-bank financial intermediaries insurance companies taxable partnerships general professional partnerships non- taxable joint ventures and enterprises duly registered with the Philippine Economic Zone. This tax evolved as shareholders began electing to have companies retain earnings rather than pay them out as dividends in an effort to avoid high levels of taxation. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary.

Attach to the corporations income tax return. The point of this tax is to encourage companies to issue dividends to their shareholders rather than sit on the earnings which ironically often leads to the. IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall apply to every corporation other than those described in subsection IRC 532b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being.

For each of 3 consecutive tax years the corporation a has accumulated earnings and profits AEP and b derives more than 25 of its gross receipts from passive investment income as defined in section 1362d3C. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the business the corporation may be assessed tax penalty called the accumulated earnings tax IRC section 531 equal to 20 percent 15 prior to 2013 of. By stevejedinak Jan 27 2022 Federal Taxation.

As a practical matter the tax is col-. The trustee must give you a completed Part IV of Schedule J Form 1041 so you can complete this form. The parties disagreed on the correct tax computation and instituted the current case to determine the right amount.

A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. Beginning in 2018 the Retained earnings Unappropriated field in Screen L-2.

It required the parties to compute the new tax liability based on the corporations holdings under the courts rule 155. The result is 0625. During the tax year did the corporation have any non-shareholder debt that was canceled forgiven or modified terms so as to reduce the principal amount of the debt.

Exempt or effectively exempt from the PHC tax. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. Closely held corporations b.

Accumulated tax earning is a form of encouragement by the government to give out dividends rather than keeping their earnings. If you received a distribution for this tax year from a trust that accumulated its income instead of distributing it each year and the trust paid taxes on that income you must complete Form 4970 to compute any additional tax liability. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

Enter the accumulated earnings and profits of the corporation at the end of the tax year. Prior to 2018 the Retained earnings Unappropriated field in Screen L-2 represented any prior C Corporation retained earnings and any booktax timing differences for the S Corporation. If you have a loss in one category of income you can apply it against income in the same category.

Divide the current year earnings and profits 10000 by the total amount of distributions made during the year 16000. Tax-exempt organizations Publicly held corporations assume it fails the stock ownership test and is not formed or availed of for the purpose of avoiding income tax f. The election terminates on the first day of the 1st tax year beginning after the 3rd consecutive tax year.

What is the Accumulated Earnings Tax. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. For instructions and the latest information.

October 2018 Department of the Treasury Internal Revenue Service. 1704 Improperly Accumulated Earnings Tax Return. September 10 2021 Corporate taxpayers that retain earnings in excess of the reasonable needs of their business rather than pay such earnings as dividends to shareholders are at risk for the accumulated earnings tax AET which is a form of penalty tax that is intended to make corporations distribute their taxable income to shareholders rather than accumulate.

The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit. It compensates for taxes which cannot be levied on dividends. Corporate Report of Nondividend Distributions.

1 accumulated taxable income is taxable income modified by adjustments in 535 b and as reduced by the dividends paid deduction under 561 and the accumulated earnings tax credit under 535 c. He accumulated earnings tax AET is imposed by Internal Revenue Code IRC section 531 on C corporations formed or availed of for the purpose of avoiding the imposi-tion of income tax on their shareholders by permitting earnings and profits to be accumulated instead of being distrib-uted. The 2018 Form 1120S includes a column for Accumulated Earnings profits on the Schedule M-2.

For calendar year ending December 31. In-come limits for eligibility are subject to adjustment annually.

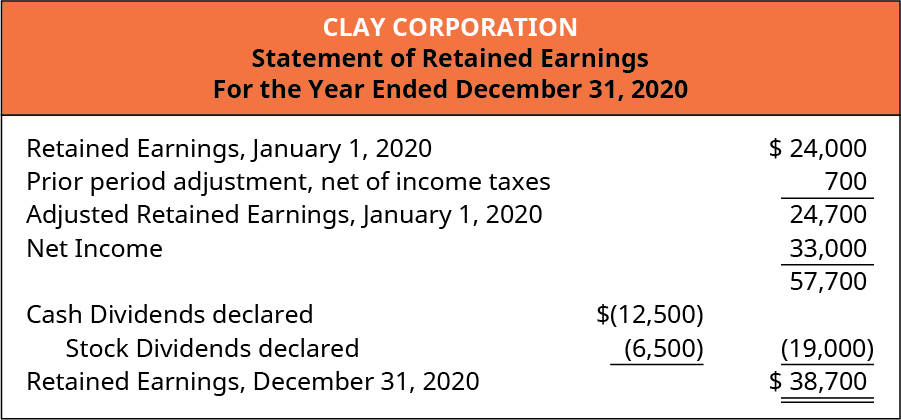

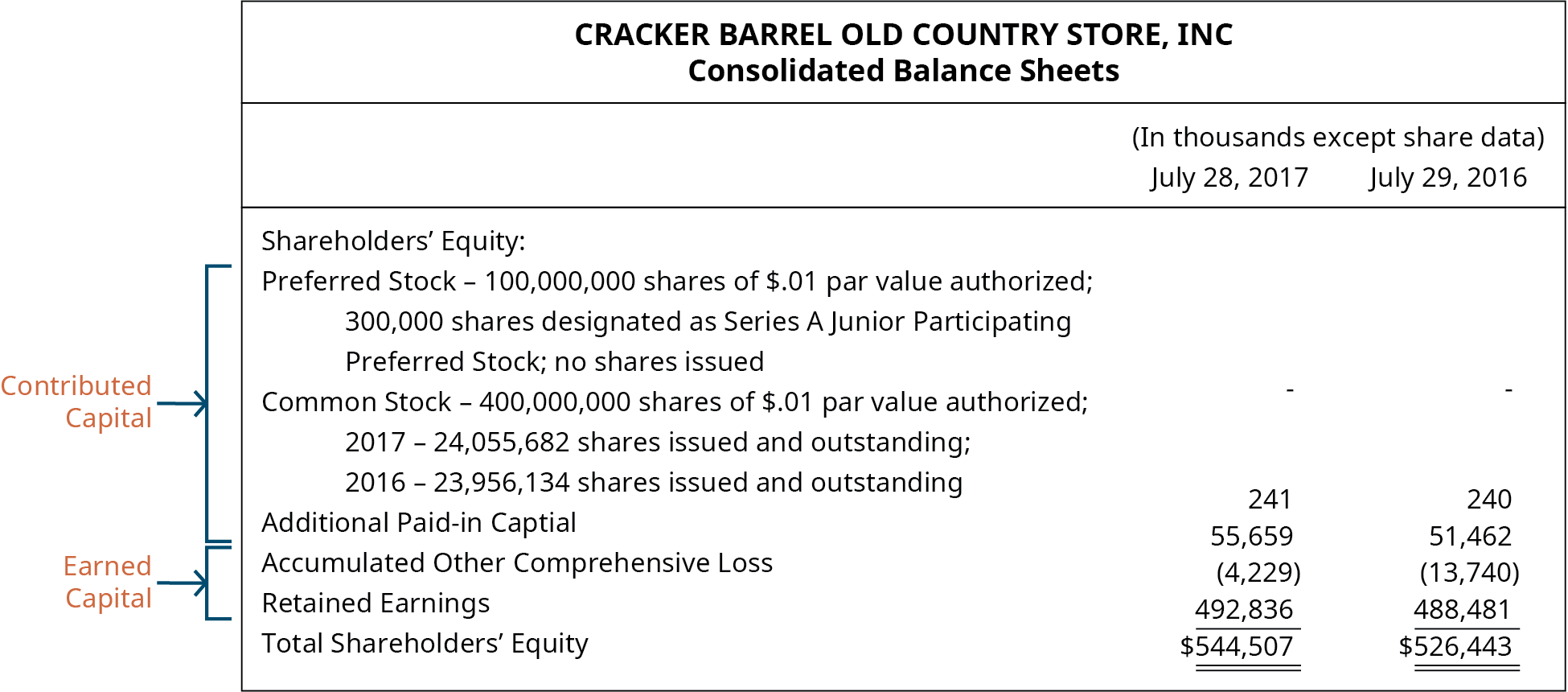

Compare And Contrast Owners Equity Versus Retained Earnings Principles Of Accounting Volume 1 Financial Accounting

How To File S Corp Taxes Maximize Deductions White Coat Investor

Earnings And Profits Computation Case Study

What Are Accumulated Earnings Definition Meaning Example

Demystifying Irc Section 965 Math The Cpa Journal

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Earnings And Profits Computation Case Study

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Fill Free Fillable Irs Pdf Forms

Earnings And Profits Computation Case Study

Fill Free Fillable Irs Pdf Forms

Determining The Taxability Of S Corporation Distributions Part Ii

What Is Form 1120s And How Do I File It Ask Gusto

Compare And Contrast Owners Equity Versus Retained Earnings Principles Of Accounting Volume 1 Financial Accounting